Marc-Antoine Collard

Chief Economist – Director of macroeconomic research

Foreword

Climate change, reduced inequality and better governance are all challenges to making our world more just and sustainable in the future, and Rothschild & Co is committed to this goal.

The Group's economic research is part of this approach, providing analysis on the main risks and opportunities to which economic players are exposed. We are therefore proud to present our first issue of ESGnomics, which aims to convey in an educational manner the contributions of economics to the discussion of Environmental, Social and Governance issues.

Climate change threatens our planet’s ecosystem and presents a grave threat to macroeconomic and financial stability. As world leaders gathered in Glasgow for COP26, cuts of carbon emissions would be urgently needed to meet the 2 degrees Celsius objective.

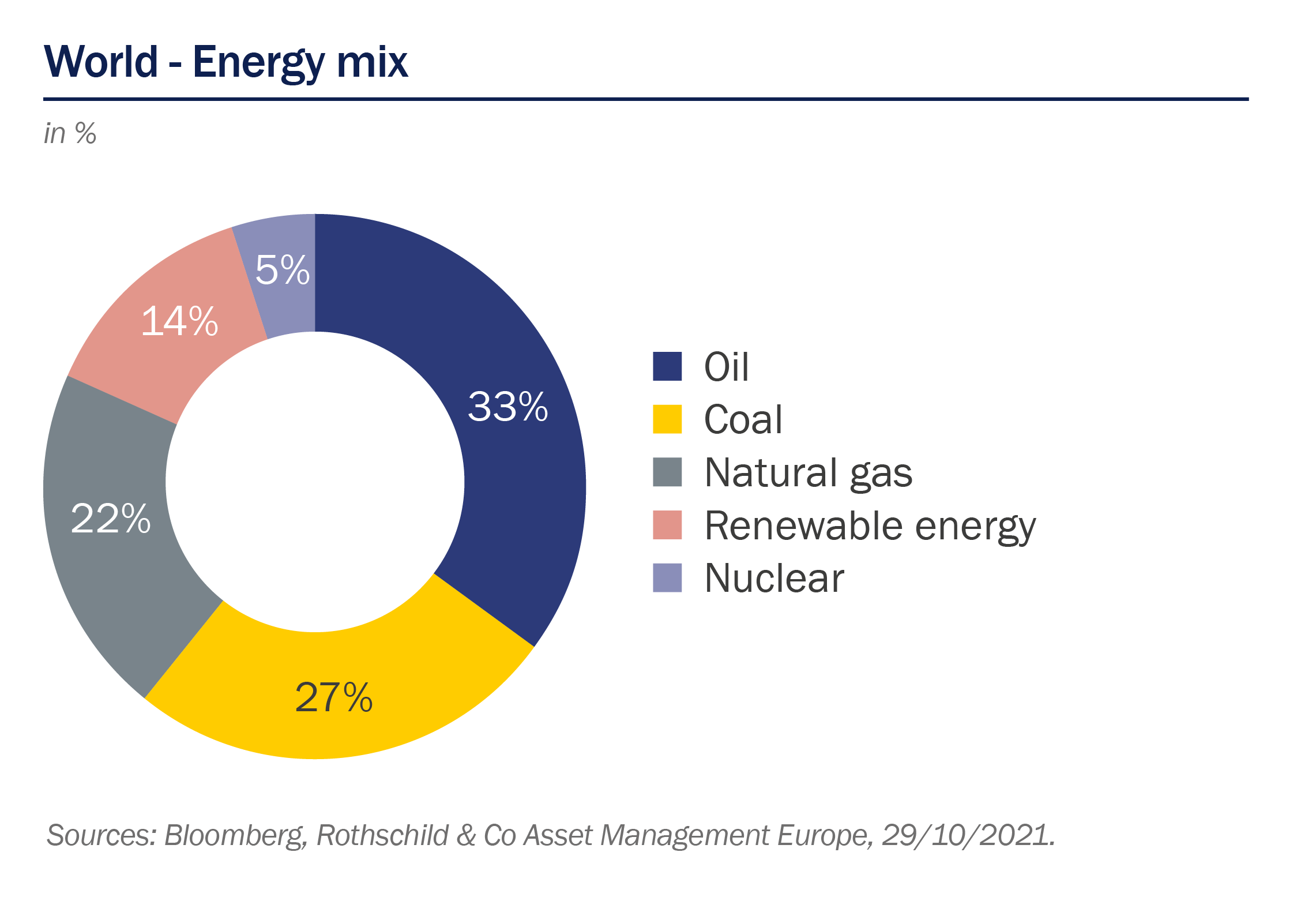

Global consumption of fossil fuels – coal, oil, and gas – has grown steadily since the pre-industrial era. This is mainly due to strong demand from advanced economies in the post-war period and, from the late 1990s, emerging economies, notably China and India. By 2020, fossil fuels were the main source of energy, accounting for over 80% of global energy consumption(1).

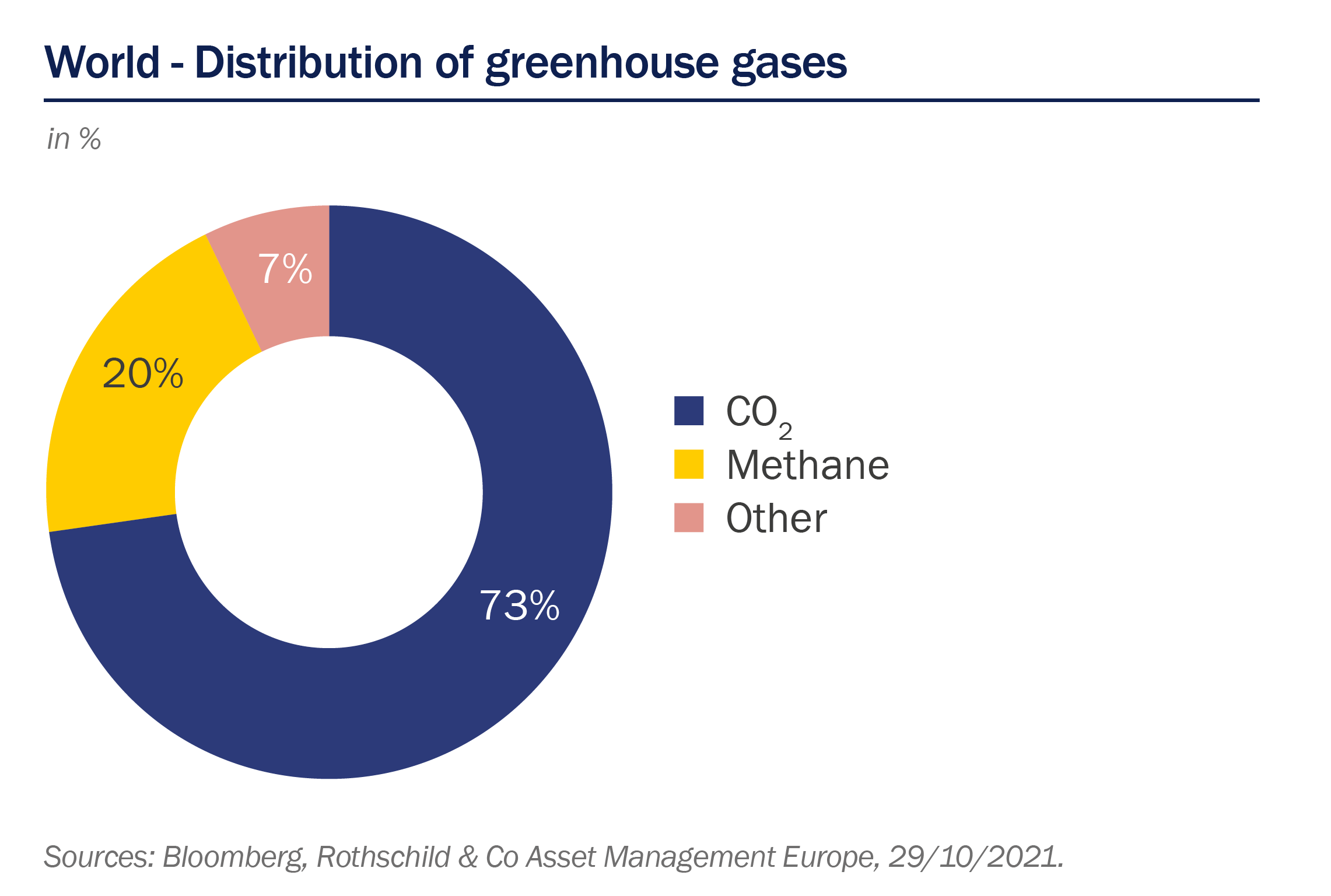

Many indicators, such as the rise in average sea level, point to a changing climate. Indeed, temperatures today are higher than at any time in the last 12,000 years, the period during which human civilization has developed. The scientific community's findings, summarized by the IPCC, now point to a consensus on the role of greenhouse gas (GHG) emissions from human activity in this change. Carbon dioxide (CO2) accounts for three quarters of these emissions and the burning of fossil fuels is by far its main source. Accordingly, public authorities have put in place policies to reduce the use of this source of energy.

Temperatures are expected to further increase in the coming decades as the concentration of GHGs in the atmosphere continues to climb, and climate change will continue as long as emissions exceed the absorption capacity of carbon sinks (forests, soils, oceans, etc.). In order to limit this trend, carbon neutrality (zero net emissions or "net zero") need to be achieved, and the amount of GHGs emitted between now and the moment when the world economy reaches this neutrality will determine the extent of climate change still to come.

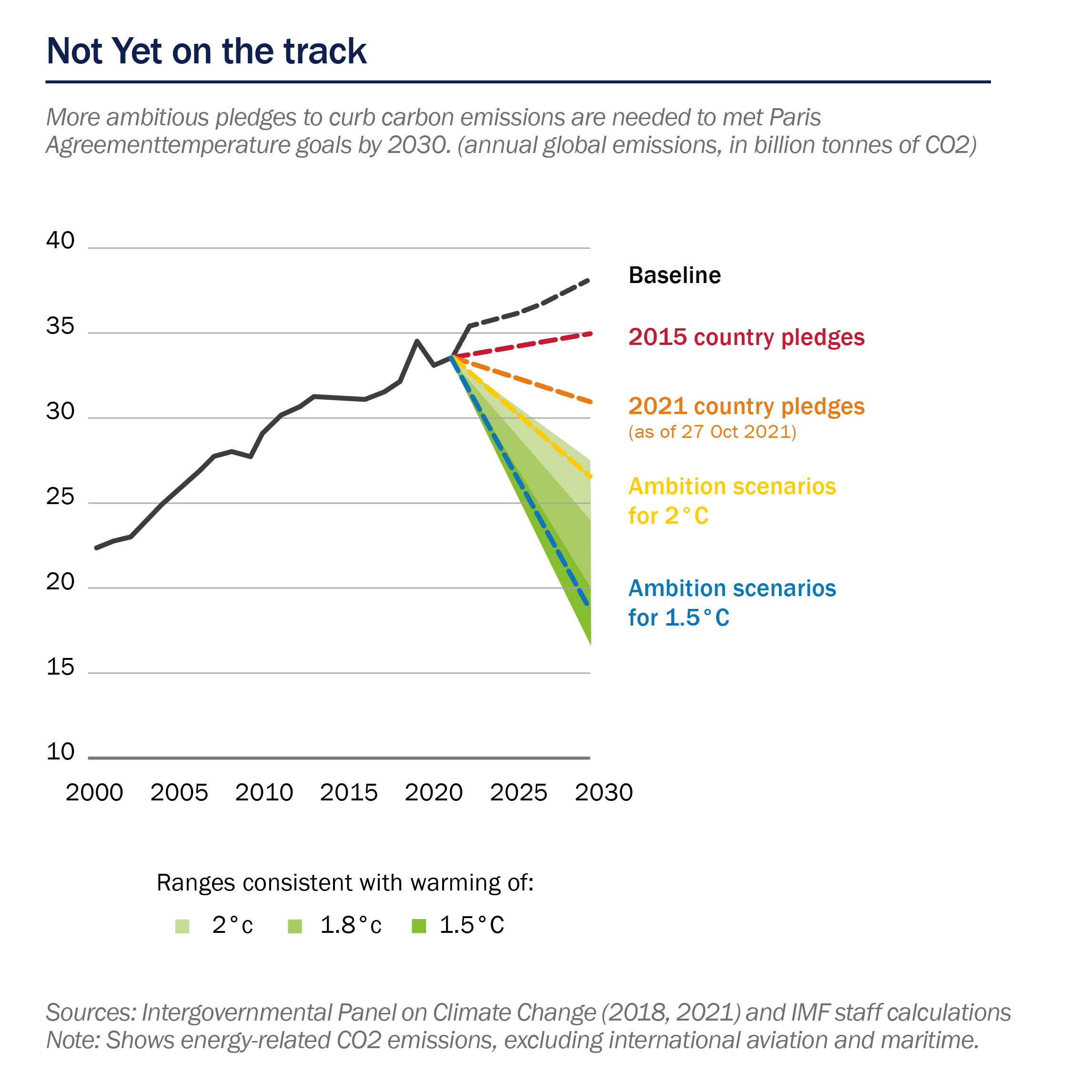

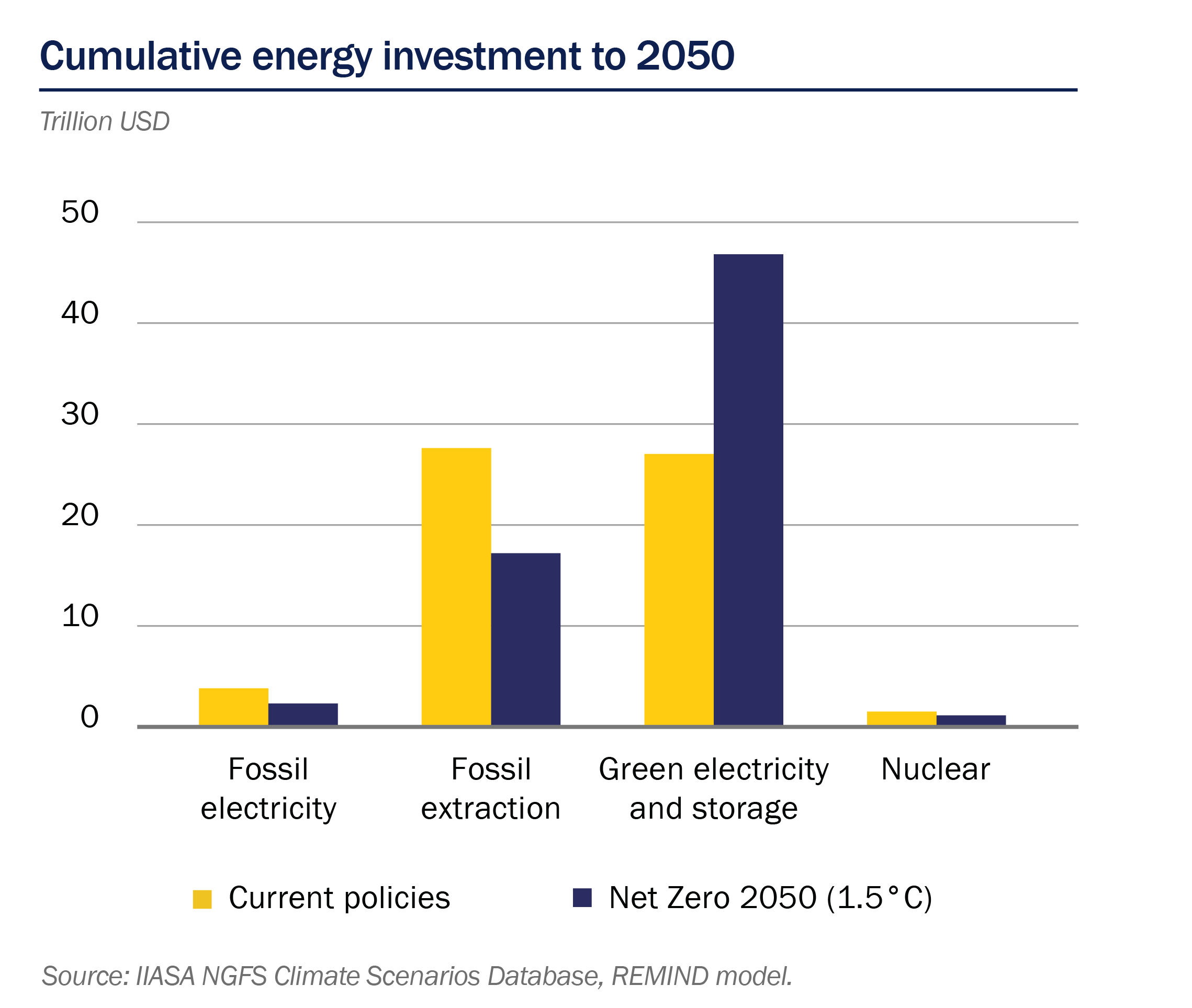

As a result, the number of countries that have pledged to reach net-zero emissions by mid-century or soon after continues to grow, now covering 135 countries, equivalent to almost 75% of global CO2 emitters(3). However, not only are most pledges not yet backed by concrete policies according to the IMF, but the International Energy Agency (IEA) warned in its latest report that the commitments made by governments are likely to be insufficient to limit global temperature rise to 1.5°C and thus avoid the damage of climate change(4). In fact, the roadmap accompanying the report stresses that substantial efforts should be undertaken now. For instance, the IEA recommends that no more investments in new fossil fuel fields should be made and that no internal combustion engine cars be sold by 2035.

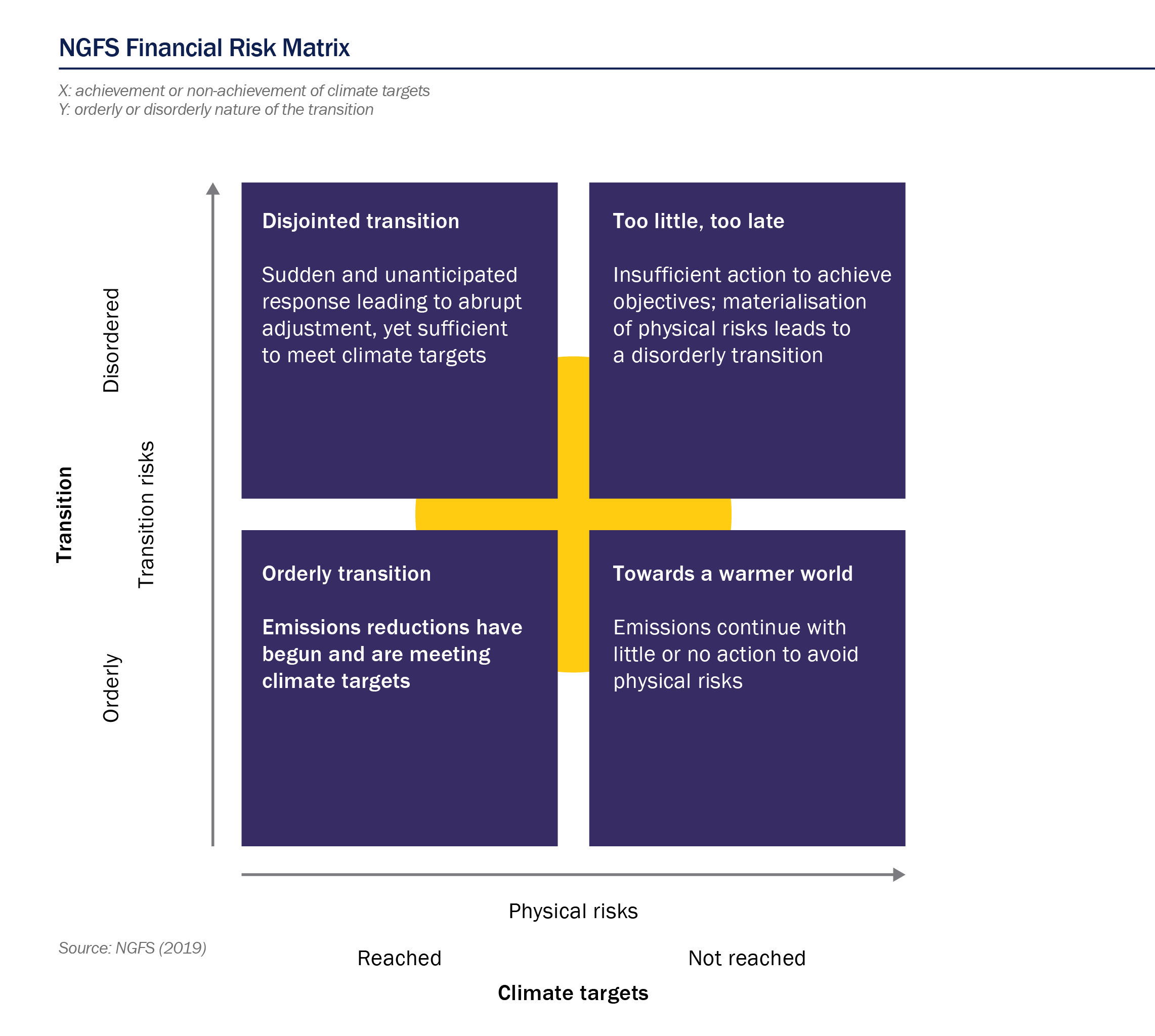

Climate change risks are generally divided into two types, each with different transmission channels to the economy.

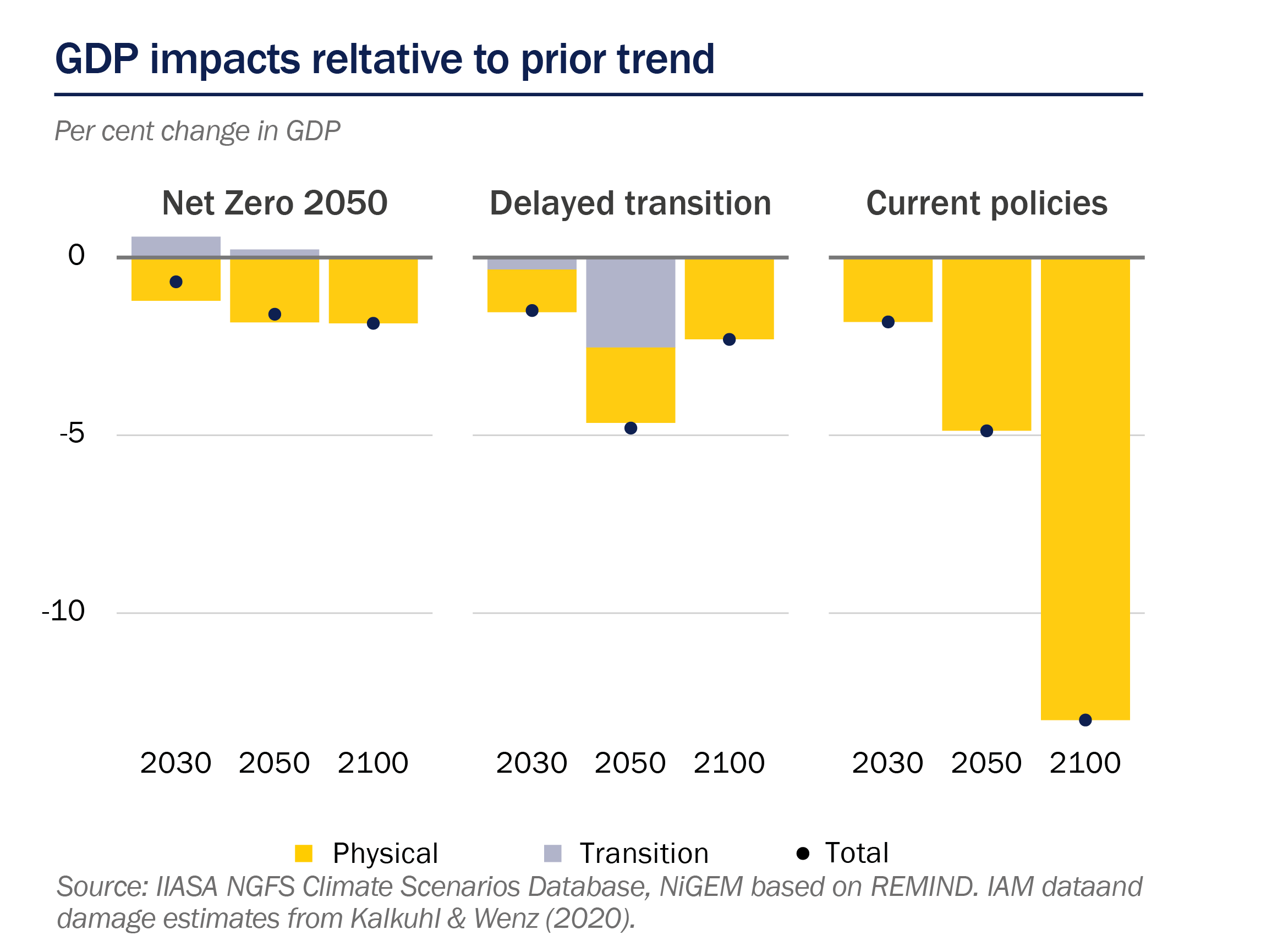

First, physical risks are associated with the direct impacts of climate warming. For example, increases in the frequency and severity of extreme events – floods, hurricanes, fires – will lead to destruction of infrastructure, disruption of business operations and massive population displacements leading to potential conflicts(5). As a result, at the macroeconomic level, we could see an increase in the rate of capital depreciation, a decline in productivity, disruptions to international trade, or a deterioration in public finances due to reduced tax revenues caused by reduced economic activity and increased spending on reconstruction efforts.

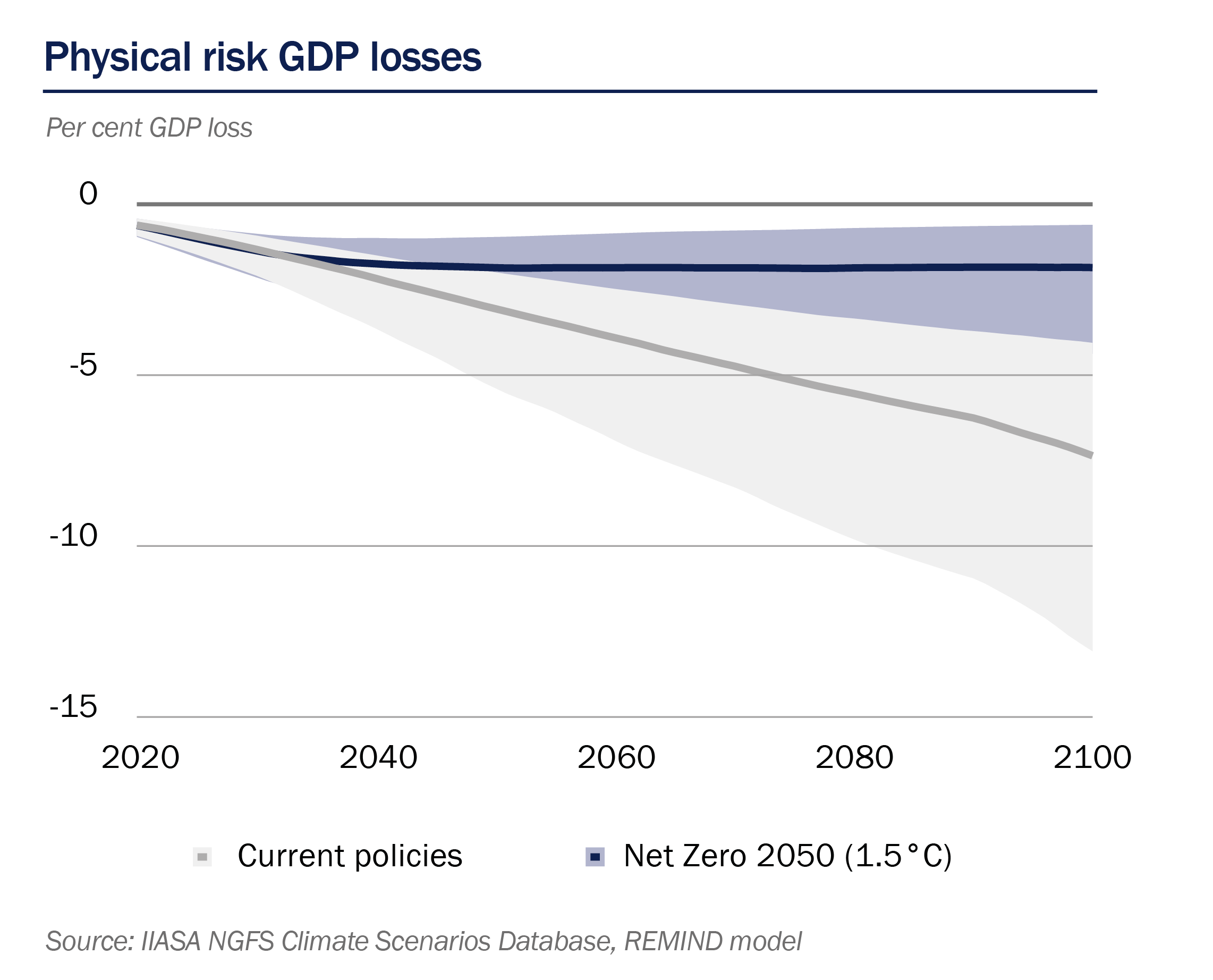

The earlier the transition is implemented, the lower the losses from physical risks, although it should be noted that by 2050 most of the physical risks will be caused by past emissions. This climate "inertia" explains why the benefits of transition measures on physical risks will only be felt later.

Second, transition risks are explained by a more or less orderly transition to a low-carbon economy and the associated structural economic changes. Indeed, the introduction of a carbon tax and regulations aimed at limiting GHG emitting activities will have an impact on the profitability of certain industries. In addition, disruptive technological innovations will make production processes and investments obsolete. The automotive sector is obviously a case in point as the capital stock used to manufacture combustion engine cars will become defunct.

A disorderly transition, e.g. one that comes in late or abruptly, obviously entails more transition risks due to the inability of some sectors to adapt in a short time, which may affect their revenues and solvency. Consequently, the impact on global GDP due to transition risks would be higher.

Moreover, behind these aggregate impacts lies important structural transformations since some sectors – such as fossil fuel producers and large GHG emitters – would be particularly affected, with domino effects due to sectoral interdependence. Ultimately, these transformations will be a source of opportunities and risks, and could also give rise to strong intra-sectoral discrimination.

However, a transition implemented in an efficient and orderly manner – i.e. with immediate and gradual reduction of GHG emissions – could also generate positive spillover effects, thanks to massive investments in the renewable energy sectors. What’s more, in many countries, the cost of moving away from fossil fuels can be offset by societal benefits, such as reduced deaths from air pollution, which are however difficult to quantify in terms of national accounts sense(6).

Overall, under certain conditions, it seems that decarbonization and economic growth are compatible and that the world economy does not need to grow less – the degrowth theory – in order to reach net zero by 2050. We will come back to these points in more detail in future editions. However, one thing seems certain: in the long run, the benefits of strong climate action will outweigh the costs of inaction.

[1] BP, Statistical Review of World Energy 2021

[2] Network for Greening the Financial System, NGFS climate scenarios for central banks and supervisors, 2021

[3] IMF, Not Yet on Track: Climate Threat Demands More Ambitious Global Action, 2021

[4] AIE, Net Zero by 2050 : a Roadmap for the Global Energy Sector, 2021

[5] The World Bank estimates that climate change could displace up to 140 million people by 2050 in sub-Saharan Africa, Latin America and Asia. Groundswell - Preparing for Internal Climate Migration, The World Bank, 2018

[6] IMF, Not Yet on Track: Climate Threat Demands More Ambitious Global Action, 2021